Current Promotions & Rebates

SEASONAL Promotions:

2025 Q1 Winter Promotion: FREE Bypass Humidifier!

Now through March 31, 2025 purchase a new Furnace from Comfort Control and receive a free AprilAire 600 Whole-House Large Bypass Humidifier (or equivalent value) with Installation! Offer good for all systems purchased and paid in full prior to March 31, 2025. Promotion must be mentioned to Comfort Advisior prior to purchase and discount cannot be applied to invoices issued prior to 12/31/2024.

* In-home feasibility assessment and assumption verification must be completed by Comfort Control personal prior to purchase.

** If desired, the value of the FREE bypass humidifier can be deducted from the cost of upgrading to a fan powered or steam humidifier.

More Info

Manufacturer Rebates:

Lennox:

Now through June 13, 2025 receive up to $2,000 in rebates OR no interest for 12 months when purchasing a new Lennox home comfort system. See the brochure below or ask your comfort advisor for more details.

Mitsubishi:

Manufacturer rebates from Mitsubishi are not available from Comfort Control at this time. Please check back at a later time for information regarding future ductless mini-split promotions.

Regency:

Manufacturer rebates from Regency are not available from Comfort Control at this time. Please check back at a later time for information regarding future ductless mini-split promotions.

WaterFurnace:

- Manufacturer rebates from WaterFurnace are not available from Comfort Control at this time. Please check back at a later time for information regarding future geothermal promotions.

MILITARY DISCOUNT:

- We are proud to offer a discount of 10% on all parts and filters and 5% on new HVAC equipment and water heaters for all United States Veterans and Active Duty Military with the presentation of a valid Military ID.

Utility Rebates:

Columbia Gas:

Columbia Gas is currently offering the following rebates to CG customers who replace an existing piece of heating equipment with a new, high efficiency model meeting the criteria below:

- $300 instant rebate for 96 percent or higher ENERGY STAR certified natural gas furnaces

- $350 instant rebate for 90 percent or higher ENERGY STAR certified natural gas boilers

- $50 instant rebate for ENERGY STAR certified natural gas water heaters with an energy factor greater than .67

- $100 instant rebate for ENERGY STAR certified natural gas tankless water heaters with an energy factor greater than .91

- $25 mail-in rebate for the purchase of a programmable thermostat

Ohio Edison:

- HVAC Maintenance Rebate Application ($50 Rebate)

- Commercial HVAC Incentive Program: http://www.energysaveoh-business.com/hvactab/hvac/

Tax Rebates and Incentives:

The following tax incentives currently exist for qualifying HVAC purchases. Please consult your tax accountant for specific information:

Residential

- 2022 Inflation Reduction Act - On August 16, 2022 the U.S. government signed into law the Inflation Reduction Act (IRA) in an effort to reduce greenhouse gas (GHG) emissions by 40% by 2030. The most meaningful impacts to HVAC are in two key areas.

- Energy Efficient Home Improvement Tax Credit (25C)

- High Efficiency Electric Home Rebate Program (HEEHRP)

- Each individual state will be administering their program and distributing funds separately and at this time Ohio has not released any additional information or details for their program. Be sure to check back to this page or visit https://www.lennox.com/owners/tax-credits/energy-tax-credits/ for more information or to see if your home/system may qualify.

- Comfort Control does not employee a CPA and cannot give tax advise, therefore we recommend all customers consult a tax professional to understand the implications of a potential purchase.

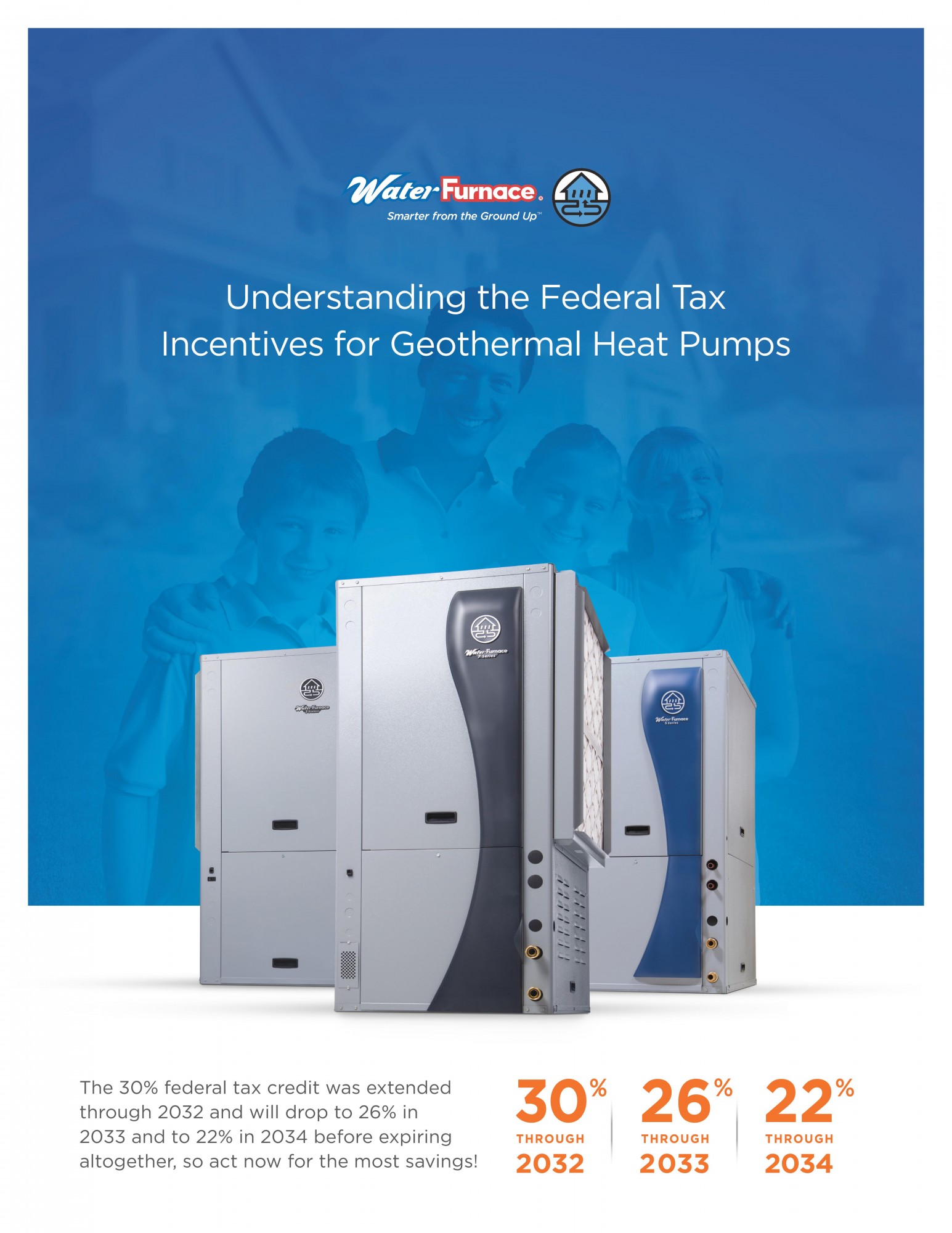

- In August 2022, the 30% tax credit for geothermal heat pump installations was extended through 2032 and can be retroactively applied to installations “placed in service” on January 1, 2022 or later. Property is usually considered to be placed in service when installation is complete and equipment is ready for use. However, if the system is part of the construction or

renovation of a house, it’s considered placed in service when the taxpayer takes residence in the house. To save the most on your installation, you’ll want to act quickly—this credit will drop to 26% in 2033 and 22% in 2034 before expiring altogether. For more information click on the WaterFurnace document below or call our office and ask to speak to one of our comfort advisors.

Commercial

- In accordance with the Tax Cuts and Jobs Act passed in December 2017, Purchases of new (and used) commercial HVAC equipment up $2.5 million, with a $1 million limit can be included as a Section 179 Deduction. See the example below, courtesy of Distribution Center Magazine:

Comfort Control - Ashland

805 E Main St

Ashland, OH 44805

Call Ashland (419-451-4241)

Email Ashland

Comfort Control - Wellington

615 S. Main Street

Welllington, OH 44090

Call Wellington (440-647-3421)

Email Wellington

Normal Business Hours:

Monday through Friday - 7:00 a.m. to 4:00 p.m.

Emergency On-Call Hours: Open 24 Hours

Toll Free: (877) 650-4328

Richland County: (419) 756-7585

Wayne County: (330) 964-8696

Ohio Lic. #47848 - Ohio P.E.#77349